A 3-2-1 mortgage buydown calculator determines the reduced monthly payments for an initial period in a stepped-down interest rate loan. It helps homebuyers estimate savings during the buydown period.

Exploring a 3-2-1 mortgage buydown offers potential homeowners an opportunity to ease into mortgage payments with temporarily lowered interest rates. This type of loan can be particularly attractive for buyers expecting their income to increase over time, allowing them to handle larger payments in later years.

The calculator streamlines the process of projecting financial commitments by accounting for the stepped reductions in interest rates over the first three years of the mortgage term. Typically, the interest rate decreases by 1% each year, starting from an initial rate 3% lower than the note rate, then 2%, and finally 1% in the third year before returning to the original note rate for the remainder of the loan. Understanding these figures upfront aids in responsible financial planning and sets clear expectations for future mortgage expenses.

Introduction To 3-2-1 Mortgage Buydowns

Exploring the realm of home financing introduces a variety of strategies to make purchasing a home more affordable. One such strategy is the 3-2-1 mortgage buydown, a creative financial tool designed to ease the initial burden of mortgage payments. This method provides a temporary discount on interest rates, bringing down the cost of borrowing for the first few years of a mortgage term.

What is a 3-2-1 Mortgage Buydown?What Is A 3-2-1 Mortgage Buydown?

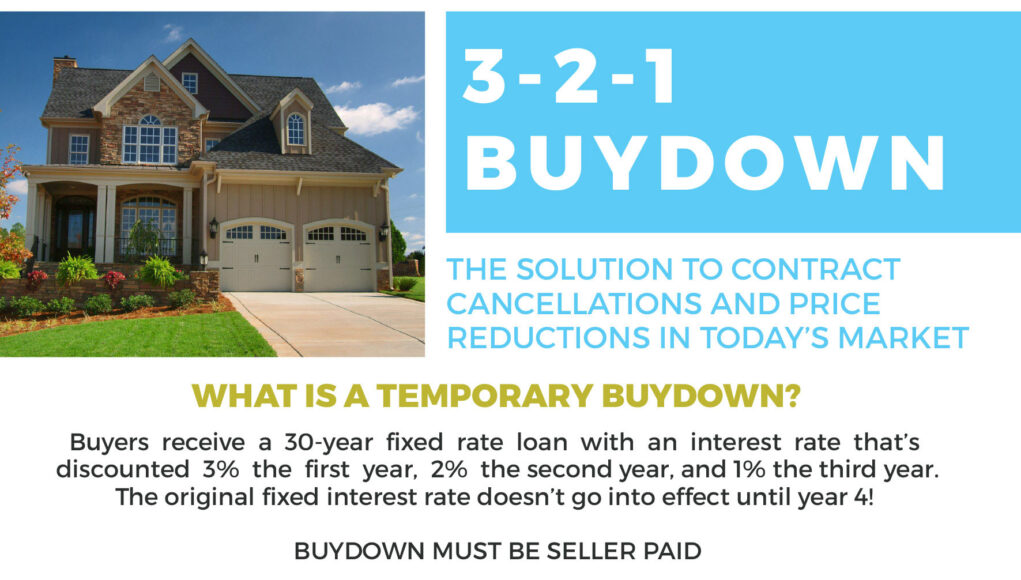

A 3-2-1 mortgage buydown involves a temporary reduction of the loan’s interest rate. This decrease typically lasts for the initial three years. Here’s how it breaks down:

- Year 1: Interest rate is reduced by 3%

- Year 2: Interest rate is reduced by 2%

- Year 3: Interest rate is reduced by 1%

After the third year, the rate returns to the original fixed rate agreed upon at the start of the mortgage. The buydown can result in significant monthly savings during those initial years.

The Impact Of Buydowns On Mortgage Rates

The impact of a 3-2-1 mortgage buydown on your mortgage rates is immediate. Buyers benefit from a more manageable payment at the beginning of their home loan.

Let’s look at the effects in a table format:

| Year | Interest Rate Reduction | Monthly Payment Impact |

|---|---|---|

| 1st Year | 3% Lower | Most Substantial Decrease |

| 2nd Year | 2% Lower | Moderate Decrease |

| 3rd Year | 1% Lower | Smallest Decrease |

| 4th Year & Beyond | No Reduction | Regular Payment |

The calculator for a 3-2-1 mortgage buydown helps determine these changes and the overall savings over the buydown period.

How The Buydown Calculator Works

Understanding your mortgage expenses just got easier with our 3-2-1 Mortgage Buydown Calculator. Unlock the advantages of a buydown and see how initial payments can reduce your interest rates over time. Let’s dive into using the calculator to make informed decisions.

Entering Loan Amounts And Terms

Start with the basics:

- Enter your loan amount.

- Input the term length of the mortgage in years.

- Key in the original interest rate before buydown.

This will set the stage for precise buydown calculations.

Calculating Reduced Interest Rates

Next, see your savings unfold:

- Input buydown costs to visualize rate reductions.

- The calculator will apply the 3-2-1 buydown structure.

- Receive adjusted rates for each year instantly.

| Year | Interest Rate Reduction | New Rate |

|---|---|---|

| 1 | -3% | Calculated Rate |

| 2 | -2% | Calculated Rate |

| 3 | -1% | Calculated Rate |

The results unravel the cost savings during the buydown period.

Benefits Of Using A Buydown Calculator

Understanding the advantages of utilizing a 3-2-1 mortgage buydown calculator can transform your home-buying experience. A buydown calculator helps potential homeowners. It computes the lowered monthly payments of the early years in a buydown mortgage. Using this tool simplifies complex calculations and offers clarity for your financial planning. Let’s delve into why this calculator is an essential tool for any homebuyer.

Accurate Monthly Payment Estimates

Stay ahead with precise estimates of your monthly payments. A 3-2-1 buydown calculator provides buyers with a clear picture. It outlines what payment amounts to expect each year. No more guessing games or rough estimations. You’ll know exactly what’s due each month, ensuring you can budget accordingly. This accuracy is priceless during the home buying process.

Long-term Savings Projections

Looking to the future is vital in the realm of finance. The buydown calculator extends its use beyond just initial costs. It provides a projection of the savings you’ll accrue over time. By showing the total interest you’ll pay before and after a buydown, it empowers you with knowledge. Knowledge that proves invaluable in making an informed decision.

Steps To Secure A 3-2-1 Buydown

Understanding the steps to secure a 3-2-1 buydown is key to unlocking the benefits of this mortgage reduction strategy. A 3-2-1 mortgage buydown can provide initial relief with lower interest rates, gradually stepping up to the standard rate over three years. Here’s what you need to do:

Negotiating With Lenders

- Initiate the conversation with potential lenders. Express interest in a 3-2-1 buydown.

- Present a strong financial profile to secure favourable terms.

- Compare offers from different lenders to ensure the best deal.

- Decide on a lender that aligns with your financial goals.

Understanding The Fine Print

Scrutinize the terms and conditions associated with your 3-2-1 mortgage buydown. Look for any clauses that may impact your finances.

- Review interest rate reductions for each year.

- Analyze long-term costs versus initial savings.

- Ensure there are no hidden fees or penalties.

- Confirm the process for rate adjustments after buydown periods.

Case Study: Real Savings Demonstrated

Welcome to our mortgage strategist’s corner, where we illuminate the real savings enabled by a 3-2-1 Mortgage Buydown Calculator through case studies. Our focus today will underscore how adjusting your mortgage rates upfront can lead to substantial financial flexibility down the line. These real-life scenarios are more than just numbers; they are stories of families and individuals who have navigated their mortgage journey smartly. Immerse yourself in the tangible benefits revealed in our following sections.

Before And After Buydown Scenarios

Visualizing the impact of a mortgage buydown can turn abstract figures into actionable insights. Picture this: a family embarks on a 3-2-1 mortgage buydown. Initially, their interest rate stands at 4%. With a buydown, it temporarily dips to 1%.

Over three years, it increases stepwise, first to 2%, then to 3%, and finally settles back at 4%. Below is a side-by-side comparison:

| Year | Interest Rate Before Buydown | Interest Rate After Buydown | Annual Savings |

|---|---|---|---|

| 1st Year | 4% | 1% | $6,000 |

| 2nd Year | 4% | 2% | $4,000 |

| 3rd Year | 4% | 3% | $2,000 |

- Total savings over three years: $12,000

Testimonials: Borrowers Share Their Stories

Nothing speaks louder than success stories told straight from the hearts of borrowers. Meet John and Maria, a couple who used a 3-2-1 Mortgage Buydown to refinance their home.

“We saved enough during the first year to put our son through private kindergarten. The buydown was a game-changer for our budget!” – John and Maria

And then there’s Emma, a first-time homebuyer, who was thrilled about the reduced initial payments:

“It gave me the breathing room to furnish my new place without the stress of a huge mortgage hanging over me.” – Emma

Comparing Buydowns With Other Mortgage Strategies

Exploring various mortgage strategies is key to finding the best fit for your financial situation. A 3-2-1 mortgage buydown can offer initial payment relief, but how does it stack up against other methods? Let’s delve into comparing buydowns with fixed and adjustable-rate mortgages, plus refinancing options.

H3 Heading About Fixed vs. Adjustable-Rate MortgagesFixed Vs. Adjustable-rate Mortgages

Understanding your interest rate options is vital when selecting a mortgage. Fixed rates stay the same, ensuring consistent monthly payments. Adjustable rates may start lower but can change, leading to uncertainty in future costs. A 3-2-1 buydown gives you an adjustable-like start with the stability of a fixed rate as you progress.

| Fixed Rate Mortgages | Adjustable Rate Mortgages | 3-2-1 Buydown |

|---|---|---|

| Stable payments | Variable interest rate | Reduced payments early on |

| No rate changes | Payments can rise or fall | Transitions to a fixed rate |

| Higher initial rates | Potentially lower to start | Discounted initial rates |

Refinancing Alternatives

Refinancing can lower your interest rate or change your loan term. However, it often involves closing costs and new loan terms. In contrast, a 3-2-1 buydown does not require refinancing to benefit from lower initial payments, and it eliminates the need for a future refinance to stabilize rates.

- New interest rate may save money over time

- Closing costs can add up

- Requires qualifying for a new loan

- No upfront rate reduction, unlike buydowns

Potential Drawbacks To Consider

Exploring the 3-2-1 Mortgage Buydown Calculator shines light on possible savings. Yet, every coin has two sides. Understanding Potential Drawbacks to Consider is vital before diving in.

Initial Costs And Fees

Upfront expenses are a reality with the 3-2-1 Buydown. Higher initial fees may apply. Let’s break them down:

- Buydown cost: This is a lump sum paid at closing to reduce the rate.

- Closing costs: The buydown may add to these customary fees.

- Lender fees: Sometimes, there’s a premium for rate reduction structures.

Remember, these costs can strain your budget. Planning is key to handle these extra amounts.

Long-term Implications And Risks

The buydown’s benefits might dim over time. Let’s consider the long-haul factors:

- Rate Rebound: After the initial period, the rate jumps back up.

- Payment Shock: Sudden increase in monthly payments can be jarring.

- Refinance Temptation: You might want to refinance, which has costs.

These implications shape your financial journey. It is crucial to assess them carefully.

Navigating The Financial Landscape With A Buydown

Exploring mortgage options can seem daunting. Yet, strategies like a 3-2-1 mortgage buydown offer appealing pathways for homeownership. This financial tool reduces initial interest rates, easing the initial cost of purchasing a home. A 3-2-1 buydown temporarily lowers your mortgage payments for the first three years. In the first year, the interest rate is three percentage points below the note rate. It’s two points below in the second year, and one point below in the third year. After that, the rate returns to the original note rate for the remaining life of the loan. Savvy homebuyers turn to a 3-2-1 mortgage buydown calculator to unravel the complexities of this financial strategy.

Preparing For Future Interest Rate Changes

Adjusting to fluctuations in the financial landscape is vital. A buydown offers a buffer against future interest rate increases. By using a 3-2-1 buydown calculator, homebuyers can predict their financial situation with greater accuracy. This foresight helps in budgeting for when interest rates reset to their original amount.

Maintaining Financial Flexibility

Financial agility is essential for handling unexpected expenses. A mortgage buydown can provide the needed room in your budget. With lower initial payments, homeowners can allocate funds to savings or investments. This creates a cushion, preparing them for any economic condition.

Conclusion: Is A 3-2-1 Buydown Right For You?

Deciding on a 3-2-1 mortgage buydown involves careful thought. This unique financing option may tempt with its initial lower payments. Yet, understanding your personal financial scenario is key. Let’s explore if this buydown strategy aligns with your goals. We’ll consider personal context and long-term planning.

Evaluating Individual Circumstances

Assessing your own financial situation is crucial. A 3-2-1 mortgage buydown calculator can offer insights. It helps weigh the pros and cons. This tool calculates your savings in the initial years and the cost increase later. Consider these factors:

- Current income levels

- Expected future income changes

- Comfort with financial risk

- Plans to stay in the home long-term

Run different scenarios through the calculator. Analyze the results carefully. This exercise clarifies if the upfront savings are worth the eventual cost increase.

Planning For A Stable Financial Future

Stable finances over time are a priority. Consider future income stability when looking at a buydown. A stable or increasing income can make a 3-2-1 buydown more attractive. Plan with these considerations:

- Anticipate income changes over the next few years.

- Factor in future financial obligations.

- Assess the overall cost of the buydown across the loan term.

- Ensure you have enough savings to handle the increasing payments.

These steps help to secure your financial position. Look beyond the short-term appeal of a 3-2-1 buydown. Make a decision in line with your long-term financial health.

:max_bytes(150000):strip_icc()/3-2-1_buydown.asp-Final-fa9d408b7f784938979231ce2d84ca58.jpg)

Frequently Asked Questions For 3-2-1 Mortgage Buydown Calculator

What Is A 3-2-1 Buydown Mortgage?

A 3-2-1 buydown mortgage is a loan with temporarily reduced interest rates, decreasing by 3% in the first year, 2% in the second, and 1% in the third, before stabilizing at the standard rate.

What Is The Cost Of A 321 By Down?

The cost of a 321 by down varies depending on location and provider. Generally, it includes an initial down payment for a service or product. To determine the exact price, contact the seller or service provider directly.

Is A 321 Buydown Worth It?

A 321 buydown can be worth it for short-term savings and lower initial payments, helping buyers adjust to homeownership expenses. Evaluate long-term affordability and interest rates before deciding.

How Do You Calculate Buydown?

To calculate a buydown, subtract the reduced loan payment from the standard payment, and multiply by the number of reduced-rate months. Then, add any upfront fees associated with the buydown.

Understanding the financial journey of home buying is crucial. A 3-2-1 mortgage buydown calculator simplifies this process. It’s an invaluable tool, offering clear insight into loan costs over time. Utilize it to shape your home-buying strategy and secure manageable payments. For empowered decision-making, leverage this smart calculator today.